Event Payment Processing Solution: How to Choose the Right One

Choosing the right payment solution is always a dilemma for event professionals as they set up the event and want to accept the payments upfront from the customers as they register. Things may seem to be overwhelming with so many things to choose from. You are left wondering about the right event credit card processing system, the average rates one has to pay for integrating a payment processor, and so on.

You surely need guidance on selecting the suitable payment processor that can affordably serve well the requirements of small and medium-sized businesses like yours. At Anchor Anchor Operating System, we take care of all your concerns regarding event payment processing. But, here is information you will find helpful to answer some of the haunting questions related to offerings and accepting online payments for your events. Here are things you need to check.

Ease of Use and Integration

The foremost issue with payment processing is how it integrates into your registration system. Due to this, it can get highly complex to shortlist your options. Therefore, you need a payment processor that can easily integrate with your website or existing systems.

E-commerce site owners must also send some basic information to the processing page. However, having more detailed customer information would be desirable. For example, you need to be able to send the name, address, and email id in one go. They shouldn’t need to enter it more than once. However, customers don’t like filling in lengthy forms. So, with specific tools integration, you can make it easy for them to fill in the whole information in one go. This seamless payment process means fewer abandonment rates, on-time payments, more bookings, with happy clients.

But, businesses may not have the technical ability to handle all this and integrate with suitable event payment systems. What may happen is sending customers to an external link where they have to pay. It is seen that 27% of the customers want to pay instantly with a direct link from the event book button, but the external link makes them leave the process midway and bounce. This is something you surely need to avoid.

Rates for Online Processing

Online processing allows your companies to run and receive payment 24*7. However, online payment falls under the category of remote payments, so they have higher rates due to laws and regulations that give these payments. Moreover, they also allow the deal to be canceled quickly with these payments for factors like not having a look at the product earlier (online stores). However, there are exceptions, for example, in the case of services or software. For products, online payment processing is riskier. That’s why payment providers charge higher rates.

But, having your business open 24 hours is an essential benefit for your business that allows customers to pay you anytime. It also allows for more complex payments, like allowing for payment plans and easy monthly installments. If you don’t offer customers payment plans or options, it can lead to fewer customers. Also, not having an online payment option means more admin work for your staff.

Important Security Features For Online Payment Processing

Fraud detection and prevention are the most critical security features your business’s online transactions. Chargebacks accompany fraudulent payments. When the clients contact the financial facilities issuing the payment without getting in touch with you, tell them they did not ask for the charge. You lose the transaction and end up paying a $25 – $45 fee.

Significantly, more than 0.5 % of businesses getting chargebacks of other transactions get flagged by a payment processor as high risk. This means you will have higher payment processing rates and may not find it feasible to take credit cards, e-checks, or other electronic payments. That’s why preventing fraudulent payments is payment processors’ is the most important security feature.

Secondly, your payment processor needs to be able to run through multiple processors to get a payment success. For example, payment processors can have various agreements with credit card companies or banks. So, there is a need to furnish different information for processing payments and achieving various transaction approvals. In other words, one processor may accept a transaction while another may not. But, this is not favorable for you when you want to see every transaction going through completion. The good thing is that event management systems, and several processors have worked to manage this requirement for you.

In addition, the system is set in such a way that if one payment processor rejects a transaction, it is routed to another processor and then still another if needed until it goes through. This increases the payment processing access by up to 76%. It sounds good, but doing all this integration work may seem too technical for small and medium companies to handle. It requires skilled professionals.

Also, if you have online registration software separately, you will end up paying for payment processors and so registration software, which is not a profitable venture. Keeping this in mind, at Anchor Anchor Operating System, we have made things simple. We customize integration for online events booking for your business and allow payment processing with our affordable packages.

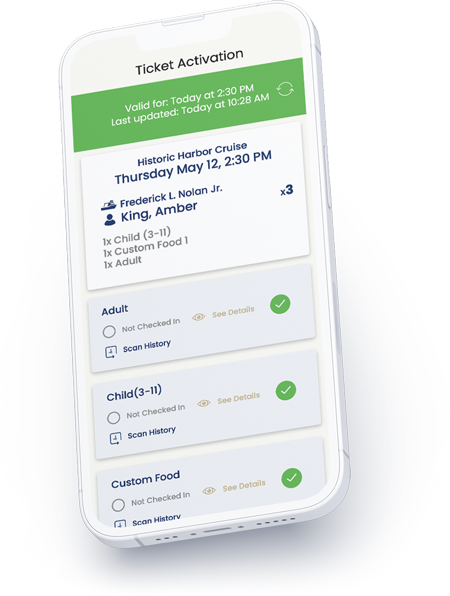

Moreover, you also get integrated payment solutions with invoicing, attendee management, and accounting, which becomes much more manageable. Anchor Operating System brings you more bookings and constantly updates you about operations with real-time, easy-to-understand reports. These are detailed integrated reports to give all the information about your income accounting and event management.

You can no longer think of avoiding using an online payment option for your customer. Moreover, an integrated API for attendee management, event management, bringing leads, and payment processing can solve all your problems in one go. And Anchor iO can do it for you. Feel free to contact us to learn more about how Anchor iO can help your business. If you’d like to continue reading, here are some of the most popular industries that Anchor serves:

-

Office

2645 Townsgate Rd, Suite 200

Westlake Village, CA 91361